Business

How To Dispute A Debt

Finding out you have a debt in collections can be stressful, especially if you don’t think you owe the money. But here’s the thing—just because a debt collector contacts you doesn’t mean the debt is automatically valid. Mistakes happen, and sometimes debts get reported inaccurately. The good news is, you have the right to dispute the debt if you believe there’s an error. Doing so can stop collection efforts until the issue is resolved.

If disputing a debt feels overwhelming, and you’re considering options to get your finances back on track, exploring debt resolution might be a helpful step. These programs can provide guidance on managing and resolving debts in a way that works for you.

Why You Might Need to Dispute a Debt

Before diving into the steps, it’s important to understand why you might need to dispute a debt. Sometimes, debts are sent to collections in error, either because of a billing mistake, identity theft, or a mix-up with another account. Other times, you might have already paid off the debt, or it’s past the statute of limitations for collection in your state. Whatever the reason, disputing the debt is your right, and it’s a way to protect yourself from paying money you don’t owe.

If a debt collector contacts you, and you believe there’s a mistake, it’s crucial to act quickly. You have a limited window of time to dispute the debt, so knowing the steps to take can help you handle the situation effectively and with less stress.

Step 1: Review the Debt Notice

When you receive a notice from a debt collector, the first thing you should do is review it carefully. This notice should include important information like the amount of the debt, the name of the creditor, and instructions on how to dispute the debt if you believe there’s an error.

Take note of the date you received the notice, as you only have 30 days to dispute the debt in writing. If you believe the debt is incorrect, don’t ignore the notice. Even if you need some time to gather your thoughts or review your records, make sure to take action within that 30-day window.

Step 2: Send a Written Dispute Letter

Within 30 days of receiving the debt notice, you need to send a written dispute letter to the debt collection agency. The letter should state that you are disputing the debt and requesting verification. It’s a good idea to be specific about why you’re disputing the debt—whether you believe it’s not yours, it’s already been paid, or there’s another error.

When writing your letter, you can use a sample dispute letter as a guide. Make sure to include your name, address, and account number (if you have it) in the letter. Also, keep a copy of the letter for your records, and send it via certified mail with a return receipt requested. This way, you have proof that you sent the dispute within the required timeframe.

Step 3: Await Verification from the Debt Collector

Once the debt collector receives your dispute letter, they must stop all collection activities until they provide you with verification of the debt. This means they can’t call you, send letters, or report the debt to credit bureaus during this time. The verification should include information about the original creditor and details about the debt.

If the debt collector can’t provide verification, they must stop trying to collect the debt altogether. If they do provide verification and you still believe there’s an error, you may need to take further action, such as contacting the original creditor directly or seeking legal advice.

Step 4: Review the Verification

If the debt collector sends you verification of the debt, review it carefully. Make sure all the information matches what you have in your records. Check the amount, the creditor, and the dates to ensure everything is accurate. If there’s still an error or something doesn’t add up, you may need to dispute the debt again or contact the original creditor for clarification.

If the verification shows that the debt is valid, and it’s something you owe, you may need to explore options for paying it off. This is where debt resolution programs can come in handy. They can help you create a plan to manage and pay off the debt in a way that’s manageable for you.

Step 5: Follow Up and Keep Records

Whether the debt is verified or not, make sure to keep all records related to your dispute. This includes copies of the dispute letter, the verification from the debt collector, and any other correspondence. If the debt is not verified and the collector continues to contact you, having these records will be important if you need to take further action.

It’s also a good idea to check your credit report to ensure the debt hasn’t been incorrectly reported. If it has, you can dispute the error with the credit bureaus to have it removed from your report.

Know Your Rights

Understanding your rights when it comes to debt collection is crucial. Under the Fair Debt Collection Practices Act (FDCPA), debt collectors are required to provide you with a written notice of the debt and your right to dispute it. They must also provide verification of the debt if you request it within 30 days of receiving the notice.

Debt collectors are not allowed to harass you, make false statements, or engage in unfair practices. If you believe a debt collector is violating your rights, you can file a complaint with the Consumer Financial Protection Bureau (CFPB) or your state’s attorney general’s office.

Conclusion

Disputing a debt might seem daunting, but it’s an important step in protecting your financial well-being. By sending a written dispute letter within 30 days of receiving the debt notice, you can ensure that the debt collector stops collection activities until they provide verification. Remember to review the verification carefully and keep all related records.

If you’re navigating multiple debts and need assistance, considering debt resolution can be a helpful way to manage your obligations and get back on track. Understanding how to dispute a debt and knowing your rights can empower you to take control of your financial situation and prevent unnecessary stress.

Business

Crew Disquantified Org: A New Way to Work Together and Succeed

In today’s fast-paced business world, companies are always looking for better ways to operate and stay ahead. One new idea that’s gaining attention is the Crew Disquantified Org approach. This model is all about breaking away from old-school, rigid ways of working and focusing more on teamwork, flexibility, and the human side of business. Instead of obsessing over numbers and strict rules, it values creativity, adaptability, and how well people work together. Let’s dive into what this means and how it’s changing the way organizations operate.

What is Crew Disquantified Org?

Crew Disquantified Org is a fresh way of organizing teams and companies. It’s about moving away from traditional hierarchies and rigid performance metrics (like sales numbers or strict KPIs) and focusing more on collaboration, creativity, and the quality of work.

The term “Crew” highlights the importance of teamwork. It’s about people working together, sharing responsibilities, and supporting one another. “Disquantified” means stepping away from relying too much on numbers to measure success. Instead, it values things like emotional intelligence, problem-solving, and innovation.

In simple terms, this approach is about putting people first. It’s about creating a work environment where employees feel valued for their ideas and contributions, not just the numbers they produce.

Why is This Approach Important?

Traditional workplaces often focus on strict rules, top-down decision-making, and measuring success through data and numbers. While these methods have their place, they can sometimes stifle creativity and make employees feel like cogs in a machine.

Crew Disquantified Org flips this around. It’s about:

- Empowering teams to make decisions.

- Encouraging creativity and innovation.

- Building trust and strong relationships among employees.

- Focusing on long-term success rather than short-term numbers.

This approach is especially relevant today, as businesses face rapid changes and need to adapt quickly. Companies that can think creatively, work together, and stay flexible are more likely to succeed in the long run.

The Core Principles of Crew Disquantified Org

This model is built on four key principles:

- Efficiency Over Bureaucracy

Traditional workplaces can get bogged down by too many rules, approvals, and processes. Crew Disquantified Org cuts through the red tape, making it easier for teams to get things done. Employees can make decisions faster without waiting for multiple levels of approval, which speeds up work and boosts productivity. - Team Empowerment

Instead of a top-down approach where bosses make all the decisions, this model gives teams more freedom and responsibility. When employees feel trusted and empowered, they’re more likely to take ownership of their work and come up with innovative solutions. - Adaptability

In a world that’s always changing, businesses need to be flexible. Crew Disquantified Org encourages teams to adapt quickly to new challenges, whether it’s a shift in customer needs, market trends, or unexpected crises. - Value-Centric Approach

This principle is about focusing on what really matters. Instead of just chasing profits or hitting sales targets, organizations using this model prioritize things like employee satisfaction, customer experience, and creative problem-solving. Success is measured by the impact they make, not just the numbers they achieve.

Benefits of Crew Disquantified Org

This approach offers several advantages for organizations, employees, and even customers:

- Better Collaboration

By breaking down barriers between teams and encouraging open communication, employees can share ideas and solve problems together. This leads to stronger relationships and a sense of community within the company. - Higher Productivity

When unnecessary rules and approvals are removed, employees can focus on the work that truly matters. This makes them more efficient and effective in their roles. - Happier Employees

People feel more satisfied when they’re trusted, valued, and given the freedom to be creative. This leads to higher morale, lower turnover, and a more positive work environment. - Faster Decision-Making

Without layers of bureaucracy, teams can make decisions quickly and respond to challenges or opportunities in real-time. This is a huge advantage in today’s fast-moving world.

Where Can This Approach Be Used?

Crew Disquantified Org isn’t limited to one industry—it can work in many fields:

- Technology: Tech companies thrive on innovation and speed. This model helps teams experiment, collaborate, and bring new ideas to life faster.

- Healthcare: In healthcare, quick decisions can save lives. Empowering medical teams to act without delays improves patient care and outcomes.

- Manufacturing: By giving workers more autonomy, manufacturing companies can streamline operations, reduce downtime, and improve product quality.

- Creative Industries: For fields like marketing, design, and media, creativity is key. This approach encourages teams to think outside the box and create groundbreaking work.

- Retail and E-commerce: Frontline employees can make decisions that enhance customer experiences, leading to happier customers and increased sales.

Challenges to Consider

While Crew Disquantified Org has many benefits, it’s not without its challenges:

- Cultural Shift

Moving away from traditional hierarchies and metrics requires a big change in mindset. Employees and leaders need to embrace collaboration, trust, and flexibility. - Training Needs

Teams may need training to develop skills like emotional intelligence, problem-solving, and collaboration. Organizations must invest in these programs to ensure success. - Maintaining Accountability

Without strict metrics, it can be harder to measure performance. Clear goals, transparent processes, and regular feedback are essential to keep everyone on track. - Resistance to Change

Some employees may be hesitant to let go of old ways of working. Strong leadership and clear communication are key to overcoming this resistance.

How to Implement Crew Disquantified Org

If your organization wants to adopt this approach, here are some steps to get started:

- Redefine Success

Shift the focus from numbers to qualitative goals, like creativity, teamwork, and customer satisfaction. - Encourage Open Communication

Create a culture where everyone feels comfortable sharing ideas and feedback. - Build a Supportive Environment

Provide training, mentorship, and resources to help employees adapt to the new way of working. - Use Technology Wisely

Tools like collaboration platforms and project management software can help teams work together more effectively. - Monitor and Adjust

Regularly check how the new approach is working and make changes as needed.

Why This is the Future of Work

The world of work is changing, and organizations need to keep up. Crew Disquantified Org offers a fresh, human-centered way to run businesses. By focusing on collaboration, creativity, and adaptability, companies can build stronger, more resilient teams that are ready to tackle whatever challenges come their way.

This approach isn’t just about doing better business—it’s about creating workplaces where people feel valued, empowered, and inspired to do their best work. And in the end, that’s what truly drives success.

So, if you’re looking for a way to make your organization more efficient, innovative, and people-focused, Crew Disquantified Org might just be the answer. Give it a try and see how it can transform the way you work!

Business

The Money 6X Rule: A Simple Way to Build Your Emergency Fund

Let’s talk approximately some thing exceptional vital: your cash. More specifically, how you could build a economic protection net that helps you sleep higher at night. Ever fear approximately what could manifest in case your automobile broke down out of nowhere? Or you unexpectedly lost your job? Life has a way of throwing surprises at us, and that they’re not constantly fun ones.

That’s in which the Money 6X Rule comes in. It’s an clean approach that will help you get ready for the unexpected. Don’t worry — you don’t need to be a monetary expert to parent it out. Let’s break it down in simple terms.

What Is the Money 6X Rule?

The Money 6X Rule (additionally known as the Money 6X Ratio) is a simple plan that says: Save up six months’ worth of your living fees. That’s it! If you typically spend $3,000 a month on hire, groceries, and different stuff, your purpose is to store $18,000 (due to the fact $three,000 x 6 months = $18,000).

This emergency fund is there to help you while things go incorrect — and they’ll, in some unspecified time in the future. Maybe you get laid off, have a clinical emergency, or need essential vehicle upkeep. Having a cushion of cash can prevent from panic and hold you from racking up credit card debt.

Why Six Months?

Good query! Six months is usually enough time for maximum human beings to parent things out. If you misplaced your task today, you’d have six months to discover a new one before you start traumatic approximately how to pay the payments. It gives you breathing room.

For a few human beings, 3 months is probably enough, especially if they live in a -earnings household or have a remarkable solid activity. But for others — freelancers, small enterprise proprietors, or absolutely everyone with unpredictable profits — six months (or maybe greater!) makes a number of experience.

How Do You Figure Out How Much You Need?

It’s pretty easy. Just test how tons you spend each month to your necessities — such things as:

- Rent or loan

- Utilities (power, water, internet)

- Groceries

- Insurance (health, vehicle, domestic)

- Transportation (fuel, public transit)

- Minimum debt payments (credit score playing cards, loans)

- Childcare (when you have youngsters)

Skip stuff like streaming subscriptions, dining out, or shopping for garments you don’t want. This emergency fund is about protecting the fundamentals, no longer luxuries.

Once you have your monthly quantity, multiply it by six. That’s your intention.

Example:

- Monthly prices = $2,500

- $2,500 x 6 months = $15,000

You’d purpose to shop $15,000 to comply with the Money 6X Rule.

How to Start Building Your Emergency Fund (Even If You Feel Broke)

Okay, I get it. Saving $15,000 or $18,000 sounds huge and scary. But don’t allow that forestall you from starting. No one expects you to have all of it saved by way of the following day. The key’s to start small and stay constant.

Here’s a step-through-step plan to get going:

1. Start With What You Can

Even $20 or $50 every week could make a big distinction over the years. The vital thing is to get into the addiction of saving. Small quantities add up quicker than you observed.

2. Automate Your Savings

Set up an automatic transfer out of your bank account on your financial savings account. If the cash actions automatically, you gained’t be tempted to spend it. Out of sight, out of thoughts!

three. Save Windfalls and Extra Cash

Got a tax refund? Birthday money? Bonus from paintings? Instead of spending it, throw it into your emergency fund. These little boosts can get you to your intention faster.

4. Pick Up a Side Hustle

If you may, bear in mind making a touch extra cash on the side. Freelance gigs, component-time paintings, or on-line jobs can help. Imagine in case you made an extra $500 a month and saved it all — you may hit your goal manner quicker.

If you’re curious approximately making extra cash, here’s a wonderful place to begin: How to Make $2,000 a Month on the Side Online (link to guide).

Where Should You Keep Your Emergency Fund?

You want this cash to be secure, clean to get to, and (preferably) earning a touch interest. But it’s no longer approximately making big returns — it’s approximately maintaining your money available when you need it.

Here are some top places to park your emergency fund:

1. High-Yield Savings Account

These are everyday savings debts that offer better interest quotes than your standard financial institution. They’re commonly on-line banks, and you may switch money in or out pretty without difficulty. It’s a safe, simple choice.

2. Money Market Account

This works a lot like a excessive-yield savings account, however you could get check-writing privileges or a debit card. It’s a chunk extra bendy, however additionally secure.

3. Certificates of Deposit (CDs)

CDs provide you with higher interest rates, but you have to depart your money in them for a set time (like 6 months or a 12 months). If you want your cash early, you’ll probable pay a penalty. A CD ladder can help with this via spreading your money over distinct CDs with exceptional adulthood dates.

four. Roth IRA (For the Right Person)

This one’s a chunk exclusive. A Roth IRA is a retirement account, but you could withdraw your contributions (not the earnings) with out penalty. It’s an choice if you’re disciplined and don’t need the coins regularly. But be cautious — this is normally higher as a closing hotel for emergency finances.

How Long Will It Take to Build a 6X Fund?

That depends for your profits and how much you can shop each month. Here’s a quick instance:

- Saving $one hundred a week = $400 a month

- $four hundred a month x one year = $four,800 in one year

- In 3 years, that’s $14,400 — almost sufficient for a $15,000 emergency fund!

Even if it takes you , 3, or maybe five years, that’s k. It’s better to make slow progress than none in any respect.

Why an Emergency Fund Is So Important

Life occurs. If you’ve ever had a massive sudden cost, you know how demanding it could be whilst you don’t have the money to cowl it. Without savings, many humans emerge as:

- Relying on credit score playing cards

- Taking out personal loans

- Borrowing from buddies or family

- Skipping bills

None of these are a laugh alternatives. Having an emergency fund offers you peace of mind. It’s like having a financial seatbelt — you may not want it each day, however you’ll be happy it’s there whilst you do.

Final Thoughts: Take Control of Your Financial Future

The Money 6X Rule is a easy, no-nonsense way to shield yourself financially. Life’s full of surprises, but you could be geared up for them with an emergency fund.

Start today. Even if you could most effective store a little at a time, just get going. Your destiny self will thank you.

And if you need to learn more about the Money 6X Rule and different smart cash pointers, take a look at out this last manual (link).

Business

Aggr8Finance: The Best financial updates aggr8finance

Introduction

In present day rapid-changing global, staying up to date with the ultra-modern economic information is crucial. Whether you are a commercial enterprise owner, investor, or simply a person looking to manage cash better, gaining access to real-time economic updates can make a large distinction. Aggr8Finance is a monetary technology platform that gives real-time marketplace insights, budgeting gear, funding tracking, and economic training to help customers make smarter financial selections.

This article explains what Aggr8Finance is, its key functions, advantages, and why it is a super platform for economic management.

What is Aggr8Finance?

Aggr8Finance is a digital financial platform that enables people and corporations control their money extra successfully. It gives actual-time monetary updates, budgeting tools, investment monitoring, and private financial planning. By the usage of advanced generation, the platform presents users with precious insights into marketplace developments, portfolio control, and economic safety.

The aim of Aggr8Finance is to provide users with easy get right of entry to to essential economic data that allows you to make properly-knowledgeable decisions.

Key Features of Aggr8Finance

Aggr8Finance gives numerous functions to enhance monetary control:

1. Budgeting Tools

- Helps customers song income and prices in actual time.

- Allows setting economic dreams and price range limits.

- Categorizes spending to recognize wherein money goes.

2. Investment Tracking

- Monitors investments and portfolio performance.

- Provides customized investment suggestions.

- Tracks stock marketplace traits and investment possibilities.

three. Financial Education

- Provides educational assets like articles and webinars.

- Helps users understand exceptional financial ideas.

- Guides beginners on the way to manipulate money efficiently.

4. Personal Financial Planning

- Creates custom designed monetary plans based on earnings and spending behavior.

- Helps customers set short-term and lengthy-time period financial dreams.

- Uses AI-driven gear to provide higher monetary strategies.

5. Integration with Financial Institutions

- Connects with banks and financial establishments for easy get right of entry to to all bills.

- Ensures easy transactions and stable financial control.

Market Trends & Financial Updates on Aggr8Finance

Global Market Impact

Financial markets are affected by worldwide occasions such as monetary regulations, change agreements, and political modifications. Aggr8Finance presents real-time updates on market conditions, supporting users recognize how international traits impact their investments and budget.

Sector-Specific Trends

- Technology: Growth in AI, cloud computing, and 5G era is shaping financial markets.

- Healthcare: Innovations in clinical research and telehealth offerings are impacting investments.

- Energy: The shift to renewable power is affecting fossil gasoline investments.

- Consumer Goods: Inflation and supply chain demanding situations impact marketplace tendencies.

By maintaining music of those traits, Aggr8Finance facilitates users live beforehand in monetary planning and investments.

How Can Users Benefit from Aggr8Finance?

Aggr8Finance gives numerous tools and functions which can assist users in different methods:

1. Smarter Financial Decisions

- Provides real-time insights for better financial planning.

- Helps customers make informed funding choices.

- Reduces dangers through AI-pushed analytics.

2. Better Investment Tracking

- Monitors market trends and provides stock updates.

- Helps customers diversify their portfolios.

- Gives personalised hints based on financial dreams.

three. Stronger Risk Management

- Identifies capacity dangers in investments.

- Suggests techniques to avoid economic losses.

- Improves monetary balance thru predictive evaluation.

4. Improved Business Financial Planning

- Helps corporations create higher monetary strategies.

- Provides insights on income rates and cash go with the flow.

- Enables organizations to enlarge operations easily.

Aggr8Finance’s Advanced Financial Products

Aggr8Finance also affords superior financial products to decorate cash control:

AI-Driven Investment Insights

- Automated Portfolio Management: Uses AI to maximize returns and decrease dangers.

- Market Sentiment Analysis: Tracks customer behavior to expect trends.

- Risk Assessment Tools: Identifies economic threats and indicates answers.

Financial Planning Tools

- Retirement Calculator: Helps users plan long-term savings for retirement.

- Debt Management Services: Assists in coping with and repaying money owed efficaciously.

- Credit Score Improvement Tools: Provides strategies to beautify financial credibility.

Future of Financial Updates with Aggr8Finance

The destiny of economic control is evolving with AI, real-time facts, and higher automation. Aggr8Finance objectives to:

- Improve financial planning with personalized insights.

- Strengthen safety with blockchain generation.

- Offer predictive fashions to count on market adjustments.

These improvements make Aggr8Finance a effective tool for future economic achievement.

Pros & Cons of Aggr8Finance

Advantages

✅ Real-time economic updates for smarter selection-making. ✅ AI-pushed insights for better funding strategies. ✅ Easy-to-use budgeting tools for non-public and enterprise finance. ✅ Strong security features like encryption and biometric authentication. ✅ Seamless financial institution integration for tracking multiple accounts.

Disadvantages

❌ Learning Curve: New customers may additionally take time to apprehend superior gear. ❌ Over-Reliance on AI: Users may rely an excessive amount of on automatic insights. ❌ Data Security Risks: Though steady, no machine is 100% safe from cyber threats.

Why Choose Aggr8Finance?

Aggr8Finance sticks out as it gives real-time insights, superior funding tools, and stable financial planning capabilities. The platform facilitates users:

- Manage personal and enterprise price range effortlessly.

- Stay knowledgeable about marketplace developments and investment opportunities.

- Securely track earnings, expenses, and savings desires.

- Make informed financial choices the usage of AI-powered analytics.

With its consumer-friendly layout and powerful financial management tools, Aggr8Finance is a superb preference for all and sundry trying to improve their monetary destiny.

Conclusion

Aggr8Finance is a dependable and superior monetary platform that offers real-time updates, funding monitoring, and financial planning equipment. Whether you are an investor, business owner, or someone seeking out better cash management, Aggr8Finance presents all the vital equipment that will help you succeed. By the usage of AI-pushed insights and secure financial generation, this platform ensures a smart and green way to control budget.

If you want to live beforehand in your financial adventure, Aggr8Finance is a notable desire that will help you make higher cash choices whenever, anywhere!

-

Entertainment11 months ago

Entertainment11 months agoBest Kickass Proxy List 2024 – 100% Working to Unblock to Access

-

Lifestyle11 months ago

Lifestyle11 months agoBanging The Underdog Incident 2022

-

Entertainment11 months ago

Entertainment11 months agoTamilMV Proxy Sites List 2025 – How to Unblock TamilMV Safely?

-

Entertainment11 months ago

Entertainment11 months agoTamilRockers Proxy 2025: 20+ Working Links, Mirror Sites & VPN Guide

-

Fashion9 months ago

Fashion9 months agoTrendy Midi Dresses for Casual Wear: Hair Care Tips Included!

-

Entertainment11 months ago

Entertainment11 months agoPirate Bay Proxy List 2025: Access The Pirate Bay Safely

-

Technology8 months ago

Technology8 months agoSSIS 469 – Detailed Guide to Understand The Features and Benefits

-

Blog9 months ago

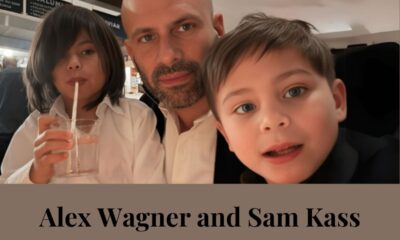

Blog9 months agoCy Kass – Family Detail of Alex Wagner and Sam Kass